So November is over, and with everything going on, having this on autopilot has been absolutely fantastic. The only time I really remember is when I see the £1,100 going out of my account!

For the full details over all of the portfolios as a summary please refer to the full month end report – this is specifically looking at what has happened on the Go T’ Pub portfolio only.

So the key bullet points for this month:

- New Funds added. As always, the regular contribution of £1,100 has gone in

- This month the portfolio threw out £52.20 from CTY – which will automatically reinvest and buy more. Compare that to my cash interest of approx. 4p (or 12p if I scale up to per quarter…) – it shows the difference that you get in income, for the hit in volatility

- No withdrawal was made

- Left over cash from the previous purchases was left in

So continue to ticking along – the second payment from CTY, so that’s over £100 now which is being reinvested, helping to offset any potential downturn that is bound to happen – this is my emergency fund after all!

Overall performance: The starting value was £12,002.06, with £1,100 in new funds added, and £0 withdrawals, meaning total starting value was £13,102.06. We finished the month on £13,025.79, so the total performance across the whole portfolio was -0.58%. Ok it’s down in percentage terms, but compared to where it was last month I am still up in actual cash terms due to my contributions.

VWRL ETF

So the standard units were purchased – a further 18 units purchased at £62.80 per unit, making the average cost per unit of £60.97 So it just keeps ticking along and increasing the number of units which all helps!

So – how does this now look as the graph data slowly builds up?

LOOK AT THAT IMAGE!!!! Yes it really is time to party… a clear gap between value and contributions…. that’s magic! Ok before I get too excited, the value is really small, and we haven’t really had any slump in prices as yet, but it is nice to see that after a (relatively) short term the value is above contributions. There is a reason most advice you see in printed material says you need to leave money in for 5 years or more… either way a very “back of fag packet” calculation of a 3% return is already giving me about £20 a month in income (3% of £8k divided by 12). Or… £60 a quarter, so a main course and a drink for the two of us in the local pub each quarter (this is London…). Not at all bad.

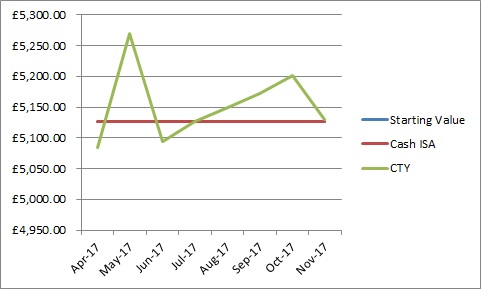

Cash vs. Investment Trust

So for me this was the more interesting part of the overall approach – I transferred 50% of my last remaining cash ISA over to an IT and will be tracking the two together to see how things perform. Remember – you really, REALLY shouldn’t do this. Keep cash on hand, be able to sleep knowing your bills would be covered etc.

So, how is it looking?

| Cash | Now stands at £5,127.14 |

| S&S ISA IT | Now stands at £5,200.78 |

Another whole 4p from cash. That’s 12p a quarter, compared to the £50+ from CTY… but I also know if I ever need to get at the cash, then the cash amount is guaranteed, CTY I will pay £12.50 (or whatever the current charge is), a few days wait to get at the funds, transfer etc. There is a difference.

So to keep with the pretty pictures, let’s see what that is looking like…

So all this time on, not a real difference between the two, but look at the difference in volatility. Worth remembering if you don’t like a bumpy ride! I do question if it is worth leaving in the starting value as it is hidden behind the cash ISA value, but one day there may be a slight difference!

Conclusion

So the drip feeding into VWRL is showing the benefits of the fire and forget approach. It’s still very early days at present – I can’t wait to see what this will look like in another few years. Although £20 a month (fag packet) is not a lot, its only 6 months of investments, so if that becomes £40 a month over a full year, in a couple of years that is going to be fantastic.

The Cash Vs. Stock is proving an interesting ride still. I won’t be happy until the stocks have enough to drop 30% and still be above the cash value (assuming stocks remain where they are) to know that it was worth doing.

Hi FiL

I really enjoy these updates and am as glad as you are to already see that gap between value and contributions – yes, it might be small right now but that gap can only get bigger, what with the likes of CTY throwing out great dividends! It’s great that it’s already giving you around £20 a month of ‘fun money’!

Anyway, wishing you and yours a very merry Christmas and hope you enjoy all that alcohol you’ve been purchasing! 🙂

LikeLike

Hi Weenie,

Glad you enjoy the updates, I have to say I have found it interesting to watch – I should be clear that the gap between contributions and value is actually only for the ETF – maybe I should do an overall one!

Yes I love the £20 a month (rough) – although it’s getting reinvested. Once it is up at around the £100 mark I can see it being used for some fun, but I may still try and not – it will help things grow faster!

Cheers, and Happy Christmas!

FiL

LikeLike

Hi,

WOW I’ve just come across your blog and I’m really enjoying it! I’ll be stopping by from now on.

Little Miss Fire

LittleMissFire

LikeLike

Hi LMF,

Thanks for stopping by! Glad you have enjoyed it and hopefully will continue to!

Cheers,

FiL

LikeLike