So January has finished, Christmas is but a distant memory – so how does it look? A hangover January? The month has screamed past with work being insanely busy meaning I only had 1 day completely off work since the 2nd January – but then I do enjoy it as it really gives me something to get my teeth into.

| Portfolio | Performance | Notes |

| Company Pension | 0.35% | No income generated as all funds are in growth or reinvested |

| Personal Pension | 0.78% | No income generated as all funds are in growth or reinvested |

| ISA 1 | 0.21% | No income generated as all funds are in growth or reinvested |

| ISA 2 | -0.41% | The performance does not include the income that was paid out into my account, and was another very good month of payouts! |

| ISA 3 | -1.56% | Although dividends are paid out, they remain in the ISA wrapper, and will get reinvested for growth. The performance figure includes both the Capital growth, and also income received which will get reinvested. |

| ISA 4 | -1.20% | Go T’ Pub ISA |

| FTSE-100 | 0.14% | This excludes any dividends |

| FTSE-250 | 0.38% | This excludes any dividends |

| FTSE-All | -1.99% | This excludes any dividends |

| S&P500 | 5.86% | This excludes any dividends |

| Dow Jones | 6.11% | This excludes any dividends |

| VWRL | -0.11% | |

| VHYL | -0.70% | |

| GBP/USD | 4.89% | This was taken on the spot rate on the close of the last day of the month. Going forwards I will pick up the exchange rate from www.xe.com for consistency and real life 🙂 |

So what to make of all this?

The obvious one for me is the strengthening of the pound – which explains why the US Markets powered up but everything else went down!

I am continued to be surprised that, despite the fees, my IFA is powering up on the returns (no I am not plugging him!) – which slightly grates as I want to show I can do better!

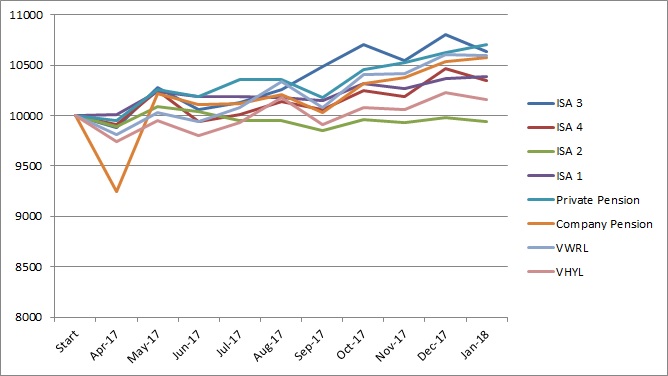

Despite all the negatives in there, the nice thing is that the absolute amount is still going up. Slowly but surely I am getting there. Putting it all into pretty pictures, it is something like this:

So amazingly after 9 months my IFA has given the best returns, even after fees, although my personal managed ISA and VWRL not that far behind. ISA 2 continues to lag the field, but then it was mostly designed to generate income and pay out (helping me further pay down the mortgage).

So not a lot to really shout about – the main thing is money goes in, invests and some comes out. The total amount is still increasing so I can be happy with the fire and forget approach.

Update: I forgot to add one of my targets – losing weight. Unbelievably I have managed to lose 1 stone since January 1st. I put this mostly down to reduction of the alcohol consumption although reducing my food intake slightly has also helped. That’s the easy win though, I think the next stone will be harder….

How was your January?

January was good! Bonus was paid and I’ve used that to get my cash back up to a more reasonable level. About 14k. I’m not saving as much as I feel I should though. There always seems to be something. My mates 40th so wanted to get him something a bit more than usual so have got him a good bottle of bourbon for 60 quid. His birthday drinks are next week and then a quick trip to Milton Keynes to practice my skiing having not done it for 3 years . Also helped my mum by paying to have her oven fixed which was 90 quid gone. And I’ll have to change some money to euros for my ski trip before March.

I’ve also now got power of attorney for my mum and having gone through her bank statements she is overspending despite a good income and the fact she barely leaves the house due to ill health. I’ve been trying to get her to cut back as it’s all discretionary spending but all I get is she’s not got much of a life (mostly self imposed sadly despite poor health) and these thing are her treats. Currently investigating equity release though I will control the capital for her or it will all be gone. A tricky situation when you have to be the adult for your parent…

LikeLike

Hi FBAB,

Always good when that bonus hits (mine is due to hit in Feb, but lets see!).

Saving always comes down to balance – save every penny and do nothing would be boring, but there is always an option to save more, just appreciate that you are way above the UK standard.

Ah a nice bottle of bourbon – I prefer the whisky to bourbon although did have a lovely bottle some years ago (would need to hunt out what it was) – but I don’t mind spending a bit on that… hopefully your mate will appreciate it!

Ah enjoy the ski practice – an expensive hobby / pastime but it is great fun, nothing quite like it for me (although sadly I won’t get to go this way).

Ah sorry to hear about having to instigate POA – it is very difficult at that stage as balancing the quality of life vs. the funds available, not easy and especially if you have any IHT implications.

I truly sympathise with the being the adult for your parent – something I can easily relate to (maybe another post coming). Are you at least fairly close location wise to help look after her?

Cheers,

FiL

LikeLike

Yes just down the road. The problem is I think a) my suggesting her to cut back with my lifestyle probably comes across as preachy (it helped I think that my girlfriend was there and pointed out that mum gets more in divorce maintenance from my dad and pension and disability benefits than she gets as a salary and she used to pay 600 a month on rent and ran a car) . She’s onAlmost equivalent to 30k a year before tax ! She’s spending over 700a month on cigarettes and food shopping and 135, every 6 weeks having her hair done. All I’ve suggested is maybe shop somewhere cheaper and buy different food and to maybe look at an alternative hairdresser. (girlfriend gets her hair cut and coloured for 55 quid!) you’d have thought I’d suggested she lives on air for a month. ‘I’ve not been on holiday for ten years I’m not like you swanning off etc etc. I’m not the most subtle person so I basically said well you can do that if you give up cigarettes and spent less at Waitrose and or maybe shopped some where a bit less expensive (I don’t shop at Waitrose i can’t afford it!) Life’s about choices and living with those choices. Probably not very tactful but it’s very frustrating when someone won’t help themselves. She’s also in debt to a friend to the tune of 10k. I could pay it off but know full well within 12 months she’d be back in the same position and I haven’t got lots of spare money floating around to keep bailing her out.

I probably sounds harsh but I’m all for helping if someone is trying to help themselves but not if they refuse to listen to reason. Sorry probably not what you want on your blog but just extremely frustrated!

LikeLike

PS re saving rate very true its about 30 to 36% of gross salary which as you say is above the norm. Alot goes into the pension so it just feels like non pension savings goes up very slowly. No must learn patience glasshopper

😉

LikeLike

Hi FBAB,

Makes life easier if you are relatively close, so hopefully that takes a little of the stress off (everything is relative!).

Sounds like your mum has an interesting spending habit – but you are right it’s about choices – ciggies definitely cost a fortune for a lost thing – she needs to learn to live within her means which is always hard.

You can’t just bail someone out as they wont appreciate the sacrifice you have made to get that, so you have to be hard to be good for them.

At the end of the day – you aren’t retired and still need to save so you don’t have that much cash to spare.

Not at all harsh – it shows the reality of some people understanding what they can and can’t budget for, but yes if people don’t want to listen there is nothing you can do – and then it has to be harsh reality sadly.

And yes – thats a great savings rate compared to 99% or more of the UK population, so be proud of that. It is incredibly slow progress and frustrating at times, but that was one of the reasons I also started my blog – so people can see it IS possible, but it is slow, takes time and patience… but it is worth it!

Cheers,

FiL

LikeLike

Interesting, why did you choose to go with an IFA? I’m more strictly a tracker person myself.

LikeLike

Hi Ms Zi You,

Simply for the advice originally, and supports me in a number of other areas rather than just managing the funds (tax advice, estate planning, mortgages etc.) and for me is genuinely worth it – as an example he has encouraged me to invest more in my own ISAs where he gets nothing.

I don’t think it is the right choice for most people, but when things get a little more complicated then it comes in to its own – provided they are a good IFA!

Cheers,

FiL

LikeLiked by 1 person