So the month has ended, and so its time to take stock of the performance across my portfolio, and compare it to the usual index of choice. This enables me to see how I am doing. As I covered in my “How I measure performance” – basically I take the value of the portfolio at the end of last month, add on any contributions for the month, and that was my starting value. End value is the value at the end of the reporting period. Simples 🙂

October zipped by with holiday and building works, and November is already seeming to get away from me with work, the best thing is though that now all my investments are on autopilot, the lack of effort required to keep investing is good.

So, how was October….?

| Portfolio | Performance | Notes |

| Company Pension | 2.85% | No income generated as all funds are in growth or reinvested |

| Personal Pension | 2.71% | No income generated as all funds are in growth or reinvested |

| ISA 1 | 1.68% | No income generated as all funds are in growth or reinvested |

| ISA 2 | 1.14% | The performance does not include the income that was paid out into my account, but is covered by the income so really need to consider both in conjunction. This was the largest month payout of income to date, fantastic! |

| ISA 3 | 2.02% | Although dividends are paid out, they remain in the ISA wrapper, and will get reinvested for growth. The performance figure includes both the Capital growth, and also income received which will get reinvested. The Income is the %age paid out by the portfolio but remains inside the wrapper to buy more goodies |

| ISA 4 | 1.84% | Go T’ Pub ISA |

| FTSE-100 | 1.63% | This excludes any dividends |

| FTSE-250 | 1.77% | This excludes any dividends |

| FTSE-All | 1.67% | This excludes any dividends |

| S&P500 | 2.30% | This excludes any dividends |

| Dow Jones | 4.52% | This excludes any dividends |

| VWRL | 3.26% | |

| VHYL | 1.69% | |

| GBP/USD | -0.86% | This was taken on the spot rate on the close of the last day of the month. Going forwards I will pick up the exchange rate from www.xe.com for consistency and real life 🙂 |

So, what to make of it all?

Well, the Dow had a stunning month, smashing everything else around (for once!) – however for diversity I would not put all of my money into just one index, so really its the VHYL/VWRL that matter to me. The VWRL is shooting up which isn’t really reflected in the Go T’ Pub performance. That said, overall across all my investments I was still up over 2% on the month – so continuing to tick up to my goal!

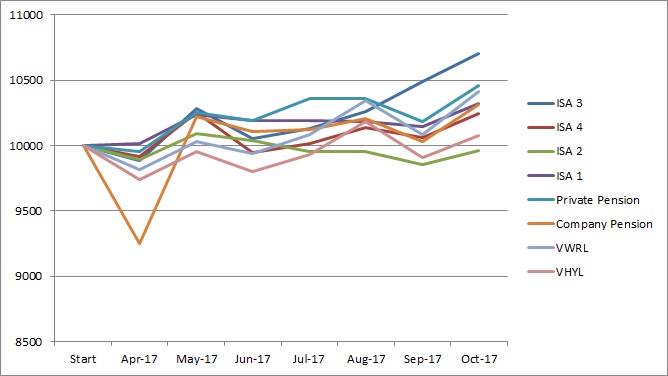

So not at all bad – the only one that is below the starting value is ISA 2 (my other half’s ISA) – but then if we add in the incomes it’s paid me out, that would be above the line. Overall, in 6 months this year, some generally good upwards ticking.

Where does this leave me on my target of 2025? Well, still not there, but another couple of months closer to the target date so definitely moving in the right direction – although caveat of the fact that the market continues to head upwards.

I have also recently started keeping a note of what my forecast liquid fund will be on my target FI date… in other words, how much can I get my hands on before my pensions are unlocked. Right now, it isn’t as high as I would like, so once my cash reserves are restored I will look to see how much I can increase my contributions to build that. Hopefully a pay rise will make that happen!

How was your October – still ticking up towards your goals?

Interesting graph, FiL and all looking good aside from ISA 2 although as you say, with income, it would be above the line. Great increase for VWRL, seems there’s no stopping it right now (sorry, hopefully not famous last words!)

My cash reserves are still pretty low (just my premium bonds really) but I want to chuck as much into my investments first. I’ll see how things look after a few more years.

LikeLike

Hi Weenie,

Thanks for stopping by! Yes as you say ISA 2 isn’t looking healthy, but if you also take into account that the money it pays out goes off the mortgage it’s a double benefit!

Yes , VWRL is on a tear right now, and I am actually finding myself concerned that I will soon not be able to buy 18 units with the regular contribution, but let’s see – the correction will happen at some point I am sure, but for now I am just continuing to sock the money in month on month!

I’ve always found I have managed to get by as is with limited challenges on my cash reserves, although they are lower than I would like right now, but ideally I would like to max out both mine and Mrs. FiL’s ISAs each year… that will be a challenge!

LikeLike

Looks like a strong month, everything moving in the right direction.

October was a decent month for me too.

I notice you have several ISA’s… Next financial year, I want to jump ship to the Vanguard ISA platform and grow a portfolio of ETF’s and index funds.

Once I open and start contributing to this new ISA, I understand that I will not be able to contribute new funds to my current ISA. But will I be able to use the dividends in the current ISA to trade on there as long as I don’t add new funds from outside of the ISA?

I hope this question makes sense! will be thankful for any response 🙂

LikeLike

Hi RMIL,

Thanks for stopping by as well 🙂 Yes, slowly, but constantly ticking up towards a magic number.

If my understanding of what you say above is correct then yes. So for me, my contributions go into my Go T’ Pub ISA and that’s the only one in my name I can put money into. My self select ISA still throws dividends out into the ISA account (note: this needs to remain in the ISA wrapper and not pay dividends into a linked bank account) and then I can still buy and sell within that account using those funds.

Hope that makes sense? But always make sure you read the rules, I am not an IFA etc. etc. etc.

Sorry for the slow response – update in a following post will explain!

Cheers,

FiL

LikeLike

thank you! makes sense to me, was a poorly worded question tbf haha

LikeLike

No worries at all – basically, what happens in your ISA stays in your ISA 🙂

LikeLike